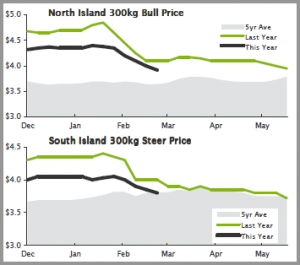

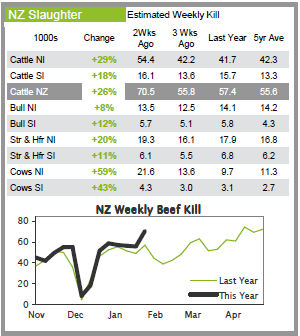

Dry conditions, particularly in the North Island, saw dairy farmers start to quit cows early. North Island kill rates are now 125% above last years levels and 90% above 5 year average levels for this time. Declining US imported beef prices are also pressuring prices here lower. On the positive side, the margin between US imported beef prices and the farmgate price is currently 15% above 5-yr average levels. This indicates meat companies have created some buffer in their margins which could start to help underpin prices at the farmgate. This week larger meat companies in both islands held their schedules for bull and steer, while manufacturing cow prices continued to move lower.

Aussies firing beef into export markets

Dry conditions across the ditch mean many farmers there are also pushing the offload button. As a result beef exports hit a record high in January. Over 55,000 tonnes of beef were exported - a 20% jump on historical Jan volumes. In comparison NZ exported 35,000t. Japan was the main receiver with the US, Korea and China rounding out the top four export destinations for Aussie beef in January. Prices will remain under pressure in key export markets with supplies running high

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283.

|